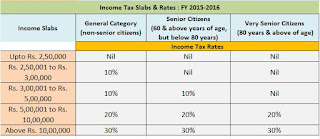

IMPORTANT FOR TAX PLANNING for A.Y 2016-17

- Deduction u/s 80C Rs 1,50,000 is same.

- Deduction u/s 80CCD has been increased by Rs 50,000 towards New Pension Scheme. The total contribution has been increased from Rs 1 Lakh to Rs 1.5 Lakh

- Deduction on account of interest on house property loan (Self occupied property) Rs 2,00,000.

- Deduction u/s 80D on health insurance premium Rs 25,000, increased from Rs 15000. For Senior Citizens it has been increased to Rs 30,000 from the existing Rs 20,000. For very senior citizen above the age of 80 years, not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure.

- Exemption of transport allowance Rs 19,200 (Increased from Rs 800 pm to Rs 1600 pm).

- Payments (Interest & maturity amounts) on Sukanya Samriddhi Account Deposit Scheme is exempted from Income Tax Under Section 80c. So it comes under Exempt – Exempt – Exempt tax category. It looks better than PPF (Public Provident Fund) now.

TRP R.K PODDAR, MOBILE - 9835639702